Many popular voices are warning about deflation while we remain in high inflation and the Fed is tightening aggressively.

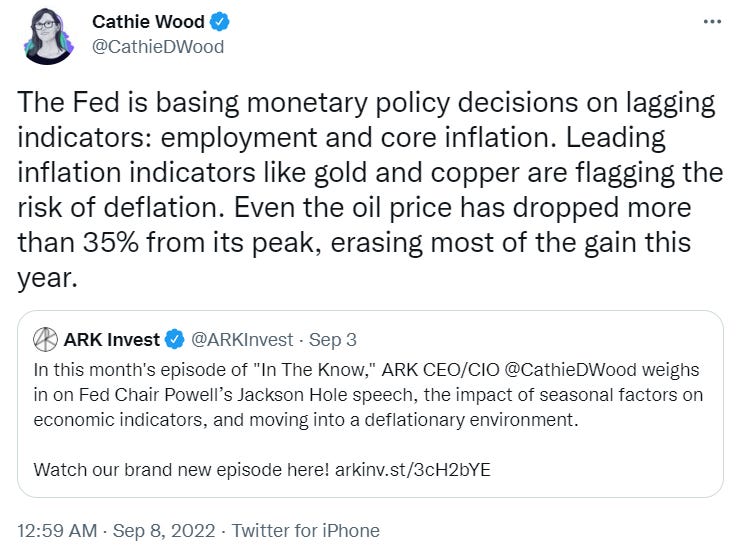

Recently, the CEO of Arc Invest, Cathie Wood, suggested potential overcorrection from the Fed and an incoming deflation.

Few days later, Elon Musk also cautioned against the risk of deflation if the Fed continues with major interest rate hikes.

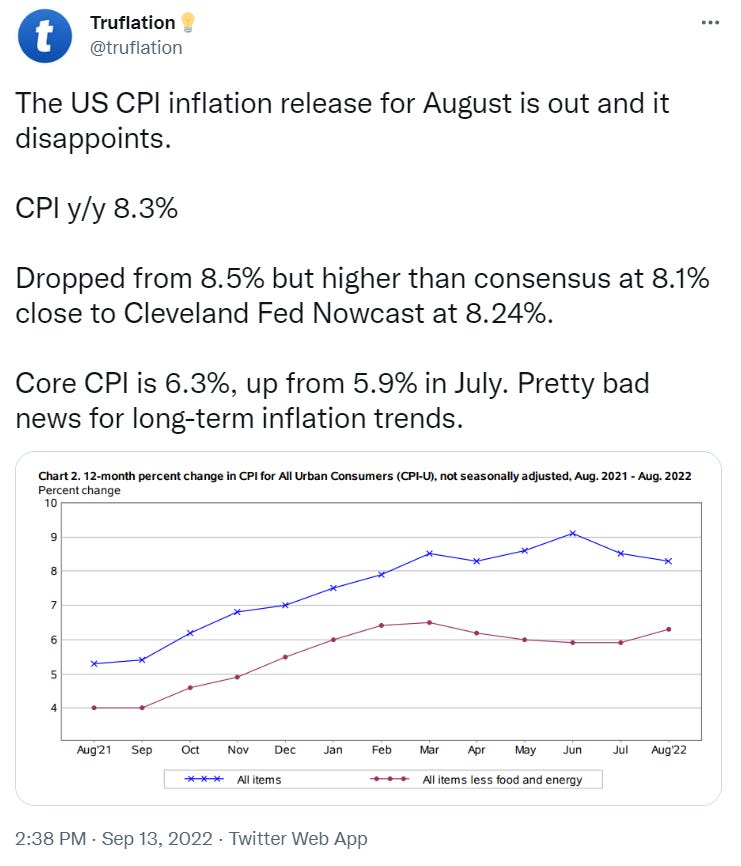

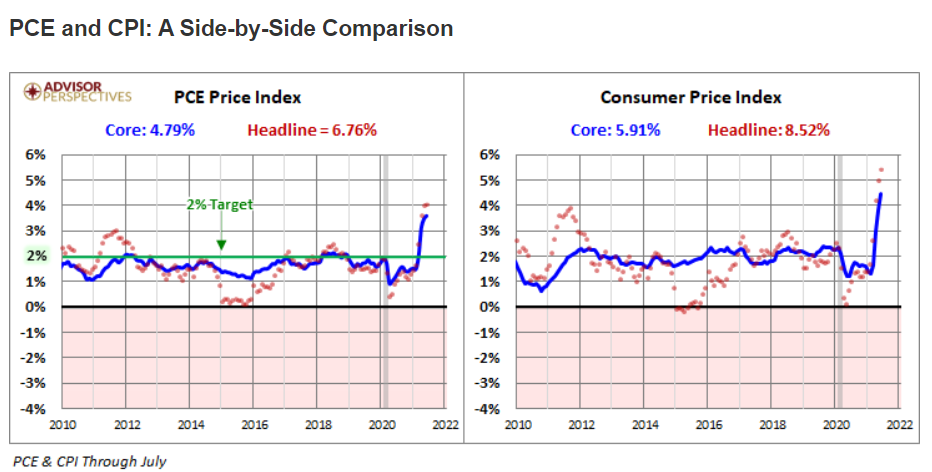

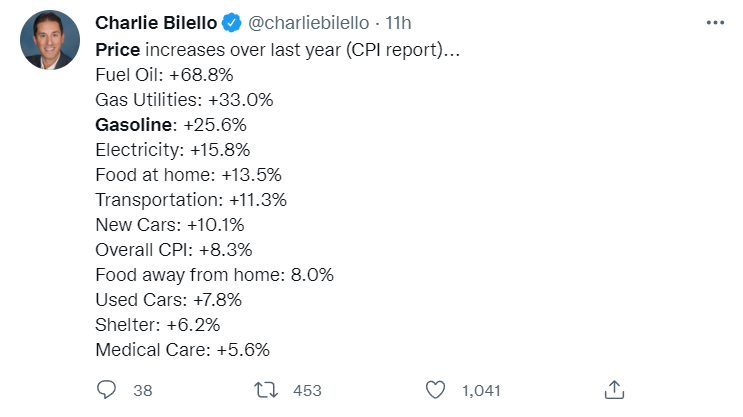

At the same time we just saw a surprisingly negative US CPI inflation read from the BSL that went higher than market expectations. The CPI increased 8.3% annually and 0.1% month-over-month, and the core-CPI was 6.3% year-over-year and increased 0.6% from July till August 2022.

The unexpected CPI report absolutely crashed the markets (heatmap 13-Sept 6:02 PM ET).

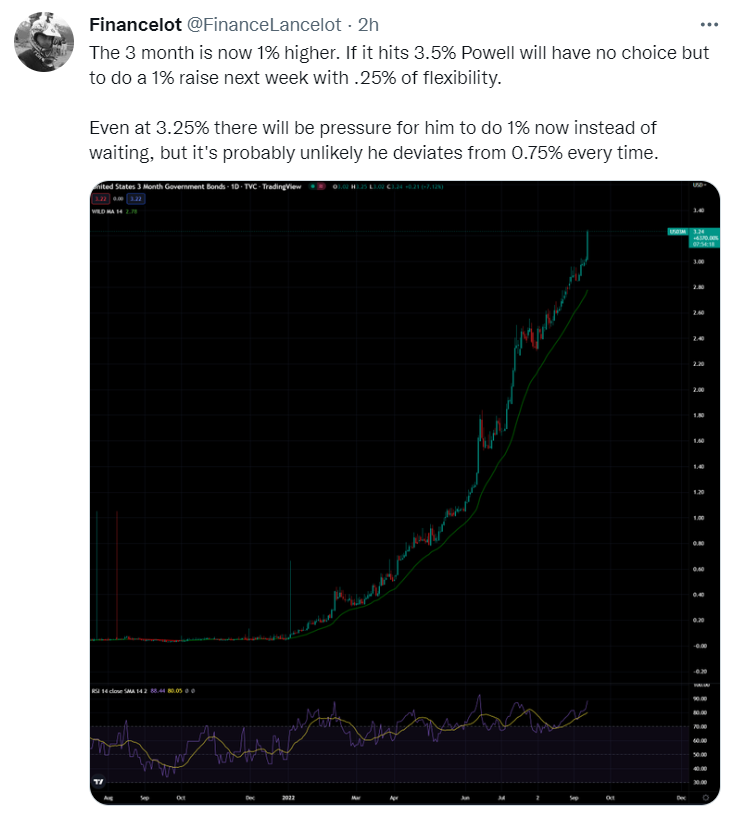

Securing the dreaded 0.75% interest hike at the upcoming September FOMC meeting.

And causing markets to speculate about a potential 1% hike and the Fed keeping the interest rates higher for longer.

So why are the popular entrepreneurs, analysts, economists, and media juggling seemingly opposite economic terms like inflation and deflation,

Potentially confusing deflation with disinflation,

And discussing them all in the context of the cost of living and the prices going back down to the last year of even pre-pandemic levels?

Well, it might be an issue of definitions and assumptions about the time period and types of inflation rather than opposing economic views.

Inflation, as the media and the Central Banks understand it, is an increase in the prices of goods and services, the most commonly reported as an annual year-over-year % change (the YoY CPI). The consumer price index, which reflects price inflation, doesn’t include asset inflation (RE, stocks, investments) or monetary inflation.

Although many crypto people, bitcoin maximalists, monetarists, and Austrian economists will argue that inflation is an increase in monetary supply (monetary inflation), that’s not the mainstream understanding of the term.

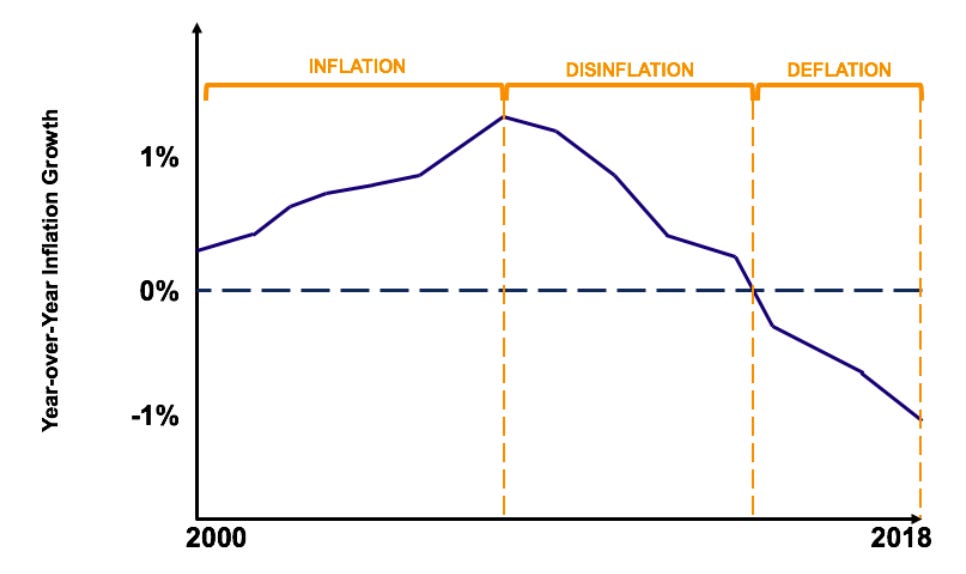

Disinflation is what we experience now, a slowing in the rate of inflation or in the ‘speed’ of price increases. But prices are still going up.

Deflation is when prices decrease, usually annually (although these days are also referred to in monthly deliberations about the MoM CPI). The Fed wants to avoid deflation by keeping yearly inflation at a 2% target to disincentivize people from hoarding cash, which is considered bad for the economy (less investment, less consumer spending).

And all of those terms still don’t mean that the prices are coming down. If prices stop increasing (monthly or annually), we have no inflation, but the prices do not decrease.

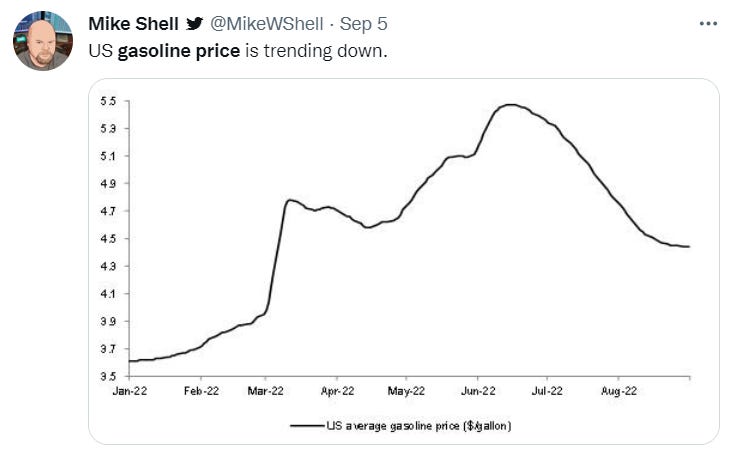

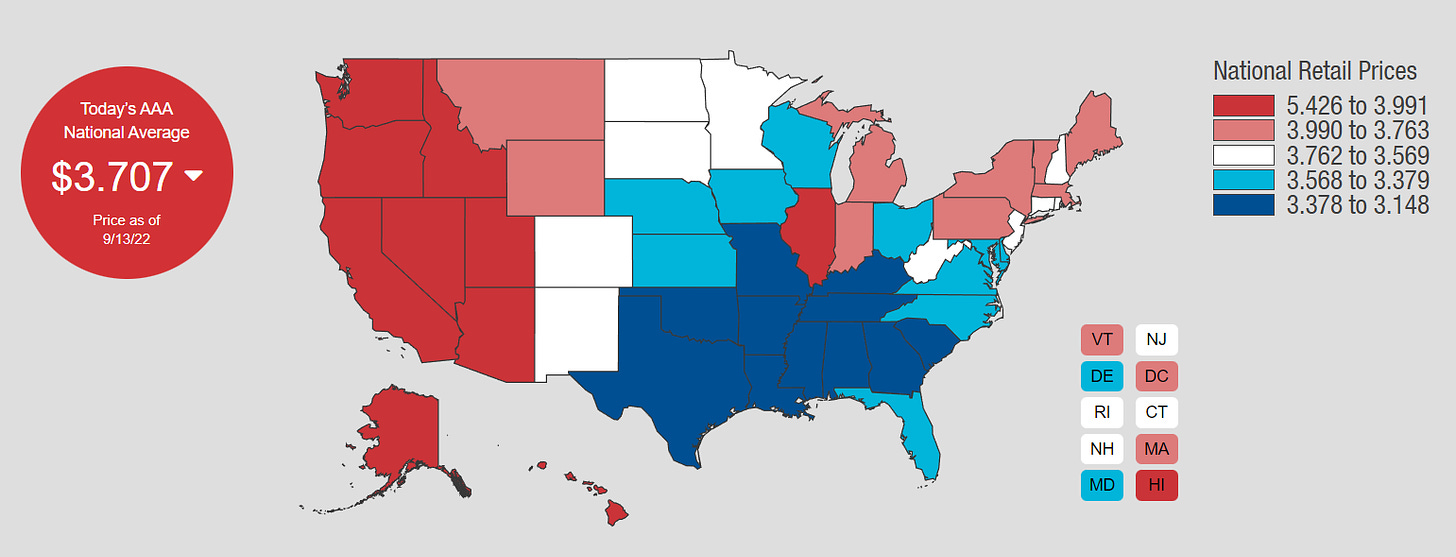

Except in special cases, like with gasoline prices.

Although they still remain 25.6% higher than last year, when inflation was already at a 5.4%.

The gasoline is also likelyto come back up after the government stops releasing its emergency oil reserves and starts restocking.

While the demand for oil and natural gas rises in winter.

Another option for the prices of goods and services to drop is for the Fed killing the demand.

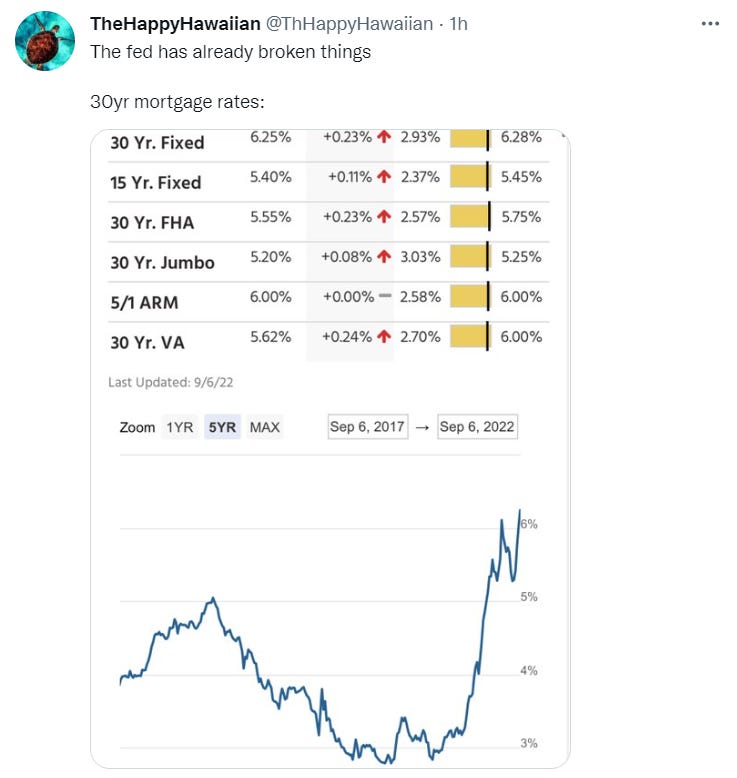

By increasing interest rates and shrinking the balance sheet, the Fed can increase mortgage rates, crash markets, topple the commodity prices, and increase unemployment in the famously strong labor market.

Which according to many traders and investors could lead to a recession or even a depression.

When talking about deflation, many analysts think stock markets, commodity markets and the housing market, that they believe will eventually affect the prices of goods (and inflation).

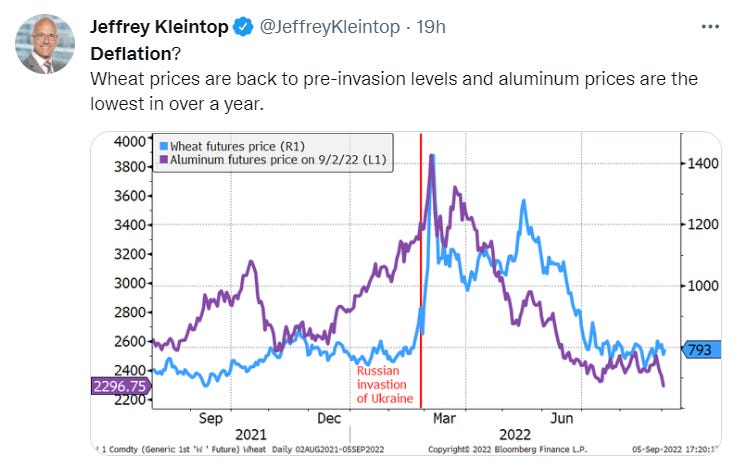

Commodity markets already signal deflation.

Doom scenarios predict a chain reaction, that would be discovered too late due to lagging indicators.

According to Cathie Wood, deflation that would affect the future PPI, CPI, and PCE numbers will come from:

Commodities

Housing market crash

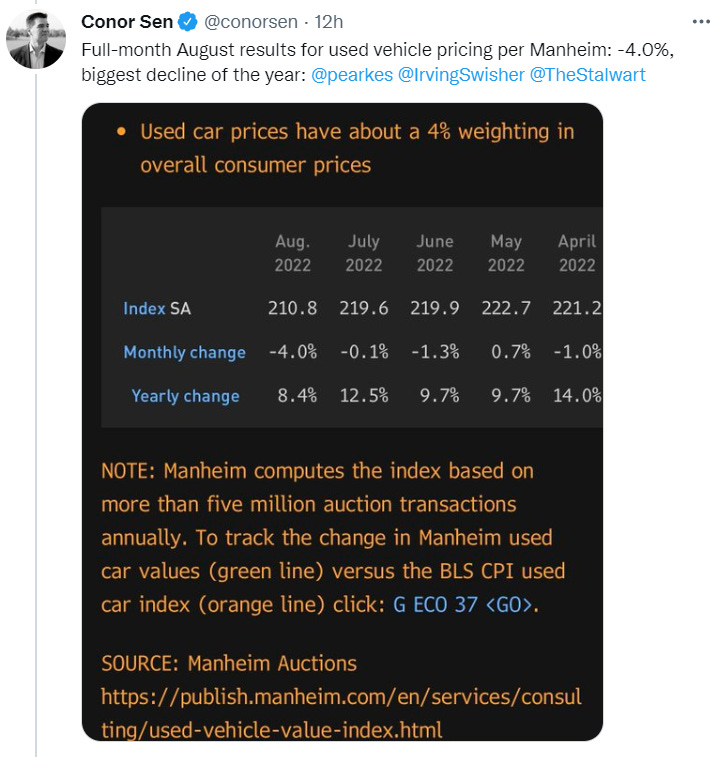

Car prices drop

Ease in the supply chains and freight costs

Excess inventories forcing shops to give discounts to clear stock

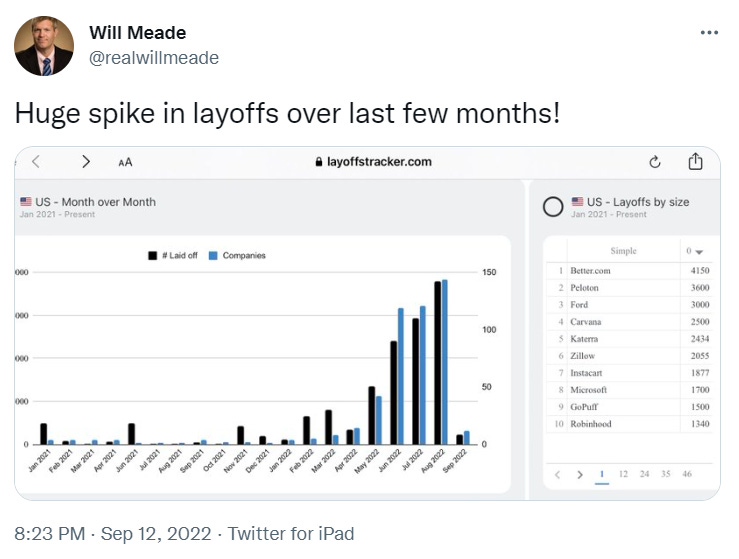

And big layoffs headlines that seem not to be reflected in the labor market metrics just yet.

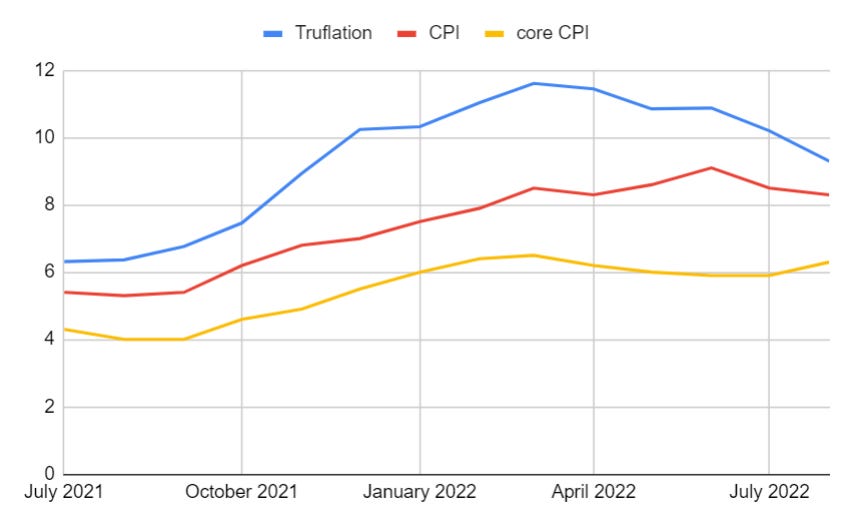

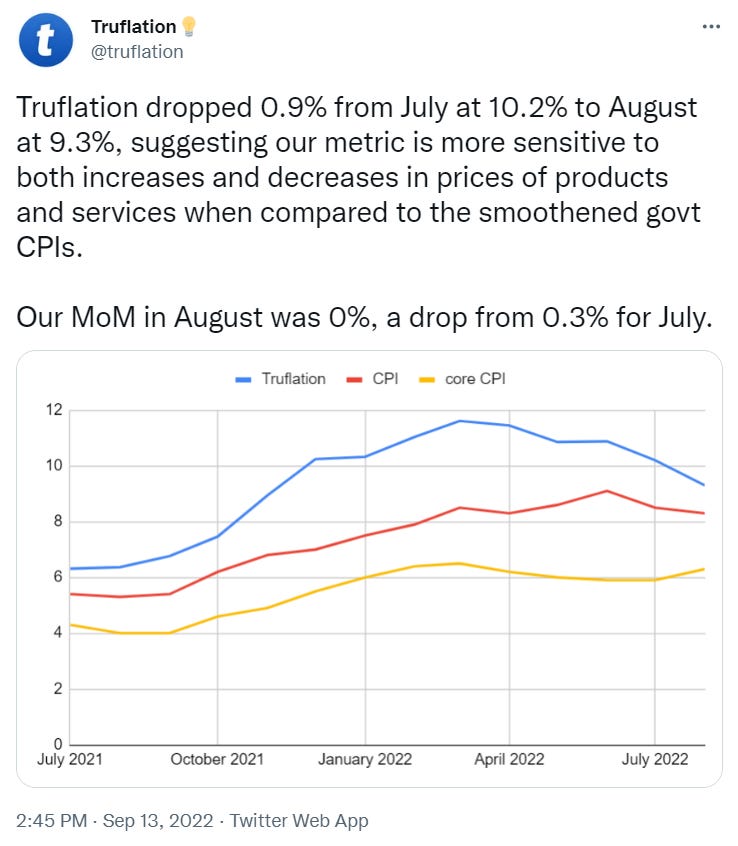

At Truflation we’ve also seen a big drop in our independent inflation metric thus far with a peak in March 2022 when the money supply peaked, months ahead of the official CPI and PCE.

The deflationary effects of the tightening could cascade down, but there are many arguments suggesting that inflation could also bounce back with the spending bills, gasoline prices, energy demand, and food shortages this winter.

Despite some disinflation, it’s still difficult to believe deflation or real price decreases could happen in the current environment or ever come back to the last year’s let alone pre-pandemic levels.

And if they do, we’ll likely be facing a much-dreaded recession and spiking unemployment with the lack of consumer demand driving those prices lower.

Excellent update. Thanks!